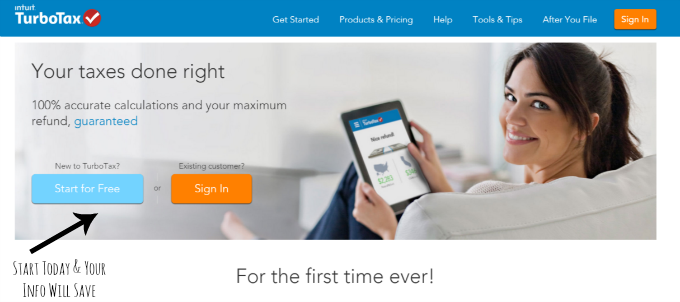

I am terrible at math and numbers and all things accounting. So is my husband. Even so, we’ve managed to file our own taxes every year with the help of TurboTax and a little determination. You can do it, too. You CAN do your own taxes online. Really you can. If the idea of doing your own taxes stresses you out, I’ve got four simple tips to help you AND save you money.

I am terrible at math and numbers and all things accounting. So is my husband. Even so, we’ve managed to file our own taxes every year with the help of TurboTax and a little determination. You can do it, too. You CAN do your own taxes online. Really you can. If the idea of doing your own taxes stresses you out, I’ve got four simple tips to help you AND save you money.

1) Gather your information all in one place. If you receive paper W2 forms, stack all of those bad boys in a file folder along with any other important information (receipts for donations, deductible purchases, etc). Student loans, the Affordable Health Care Act, home purchases, investments, and anything else that affects your finances needs to be gathered. If you have online versions, create a folder on your computer and store it all together so you’ll have it when you need it. This will save you a ton of time later when you are trying to file and need that one thing.

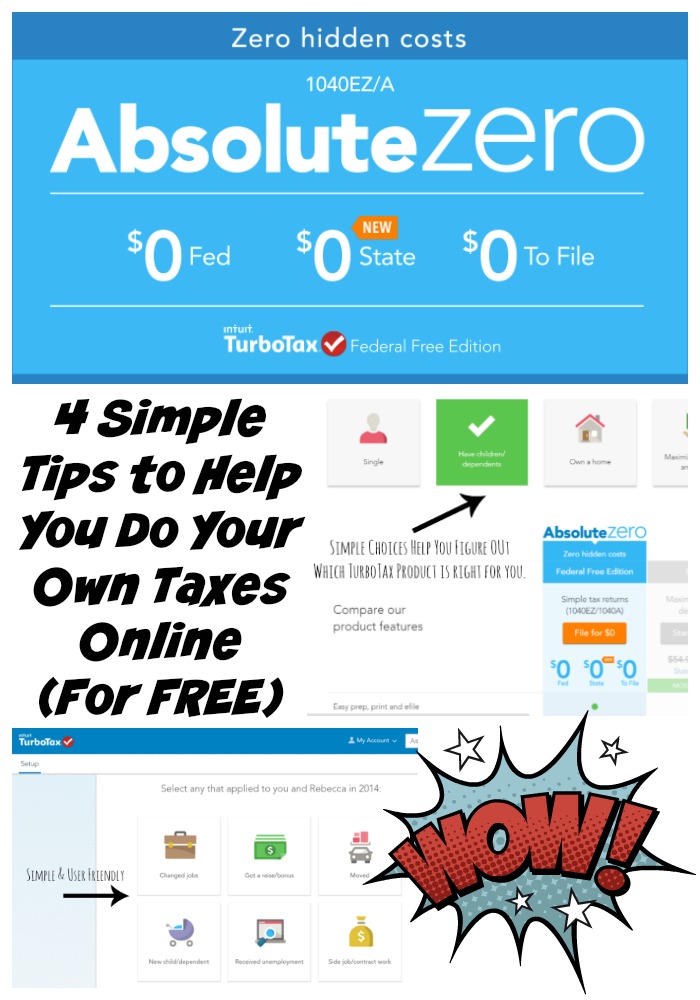

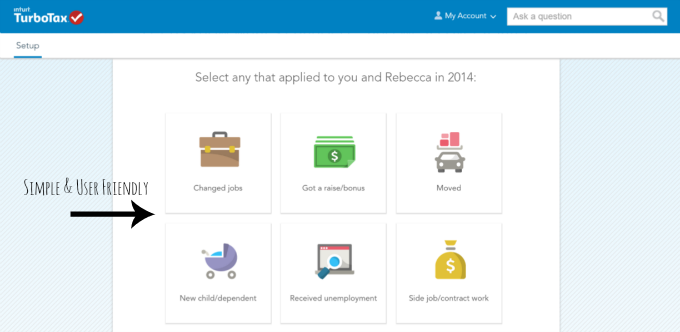

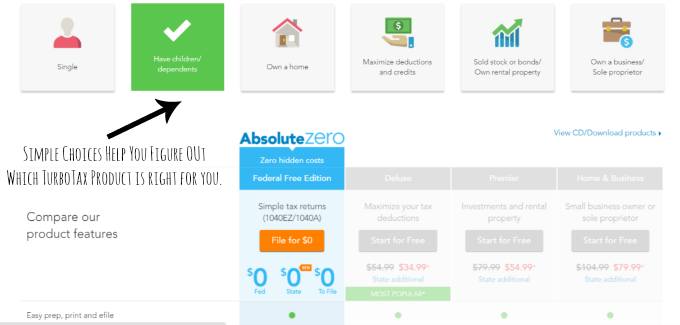

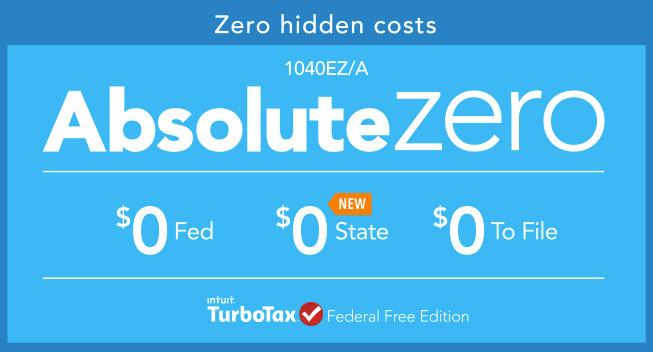

2) Use TurboTax to make it easy and FREE. We’ve used TurboTax to file our taxes for the last 7 years and LOVE it. It really makes it easy for us and lays out everything we need to do in a user friendly format. Best of all, if you file a simple return you can use the new TurboTax Absolute Zero – free for your federal return, free for your state return, and free to file. It costs you NOTHING. Seriously, it costs ZERO. Even if you have a more in depth return (like we do), all of the TurboTax products are affordable and easy to use. Absolute Zero is perfect for students, first time filers, and those who don’t own a home or have investments. Over 60 million Americans will file a 1040A or 1040EZ return this year and if you are one of them you can do it for FREE with TurboTax. You can import your W2, get expert support, claim the Earned Income Credit, and complete any ACA forms. Again, all for free. There is no catch. TurboTax is the only tax filing product that is FREE for state and federal filing.

2) Use TurboTax to make it easy and FREE. We’ve used TurboTax to file our taxes for the last 7 years and LOVE it. It really makes it easy for us and lays out everything we need to do in a user friendly format. Best of all, if you file a simple return you can use the new TurboTax Absolute Zero – free for your federal return, free for your state return, and free to file. It costs you NOTHING. Seriously, it costs ZERO. Even if you have a more in depth return (like we do), all of the TurboTax products are affordable and easy to use. Absolute Zero is perfect for students, first time filers, and those who don’t own a home or have investments. Over 60 million Americans will file a 1040A or 1040EZ return this year and if you are one of them you can do it for FREE with TurboTax. You can import your W2, get expert support, claim the Earned Income Credit, and complete any ACA forms. Again, all for free. There is no catch. TurboTax is the only tax filing product that is FREE for state and federal filing.

3) File NOW. Don’t procrastinate. Why does filing early help simplify doing your own taxes? The longer you wait, the more you’ll stress. If you do it in January, February, or March, you won’t be backed up against the deadline and worried about running out of time. Too many times I waited until the second week of April to even start thinking about filing. Not this year, people. We are knocking it out early with the help of TurboTax and looking forward to our refund.

3) File NOW. Don’t procrastinate. Why does filing early help simplify doing your own taxes? The longer you wait, the more you’ll stress. If you do it in January, February, or March, you won’t be backed up against the deadline and worried about running out of time. Too many times I waited until the second week of April to even start thinking about filing. Not this year, people. We are knocking it out early with the help of TurboTax and looking forward to our refund.

4) Save all of your information for next year. Each year after we finish filling our taxes with TurboTax, we print off important pages and file them in our tax file. We also write down our log in information to make filing even easier next year.

Do you file your own taxes online? What helps you get it done?

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.